Fill in Your California 3506 Template

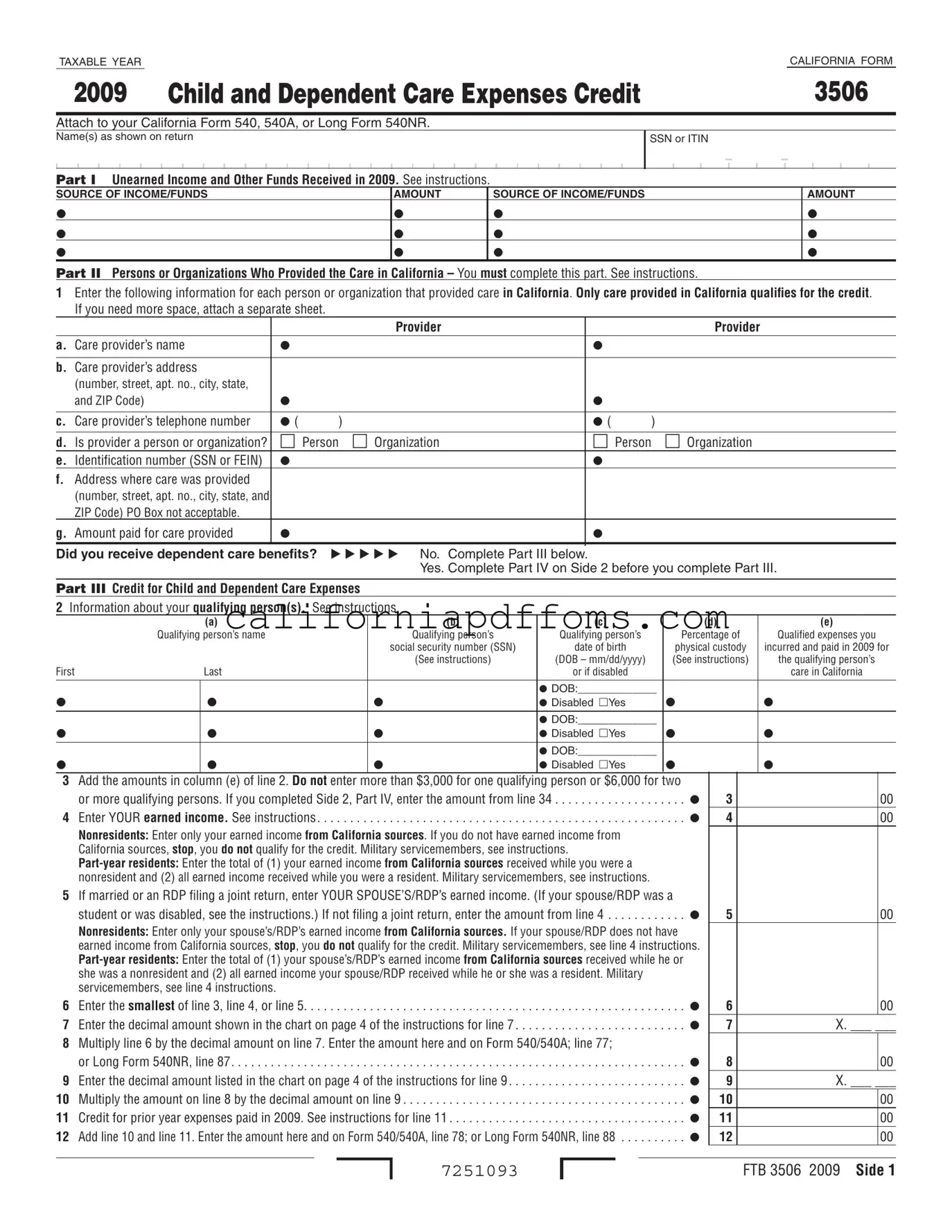

The California Form 3506 is an essential document for taxpayers seeking to claim the Child and Dependent Care Expenses Credit. This form plays a crucial role in helping families offset the costs of care for their children or dependents while they work or look for work. When filing, you will need to attach this form to your California income tax return, specifically Form 540, 540A, or Long Form 540NR. The form consists of several parts that gather information about your income, the care providers, and the qualifying expenses incurred during the tax year. In Part I, you report any unearned income and other funds received. Part II requires details about the individuals or organizations that provided care, emphasizing that only care rendered in California qualifies for the credit. Part III focuses on the credit calculation based on the qualifying expenses incurred for your dependents. If you received dependent care benefits, Part IV will guide you through reporting those amounts. Understanding the details of Form 3506 can help ensure that you maximize your eligible credits and ease the financial burden of dependent care.

Create Common PDFs

Ftb 3803 - A total of $1,900 or less on line 4 allows the parents to skip lines 5 and 6.

Ch800 - Ensure that all information on the form is true to avoid any legal complications.

File a Motion for Child Support - The form's structure assists in organizing necessary information clearly.