Fill in Your California 3500 Template

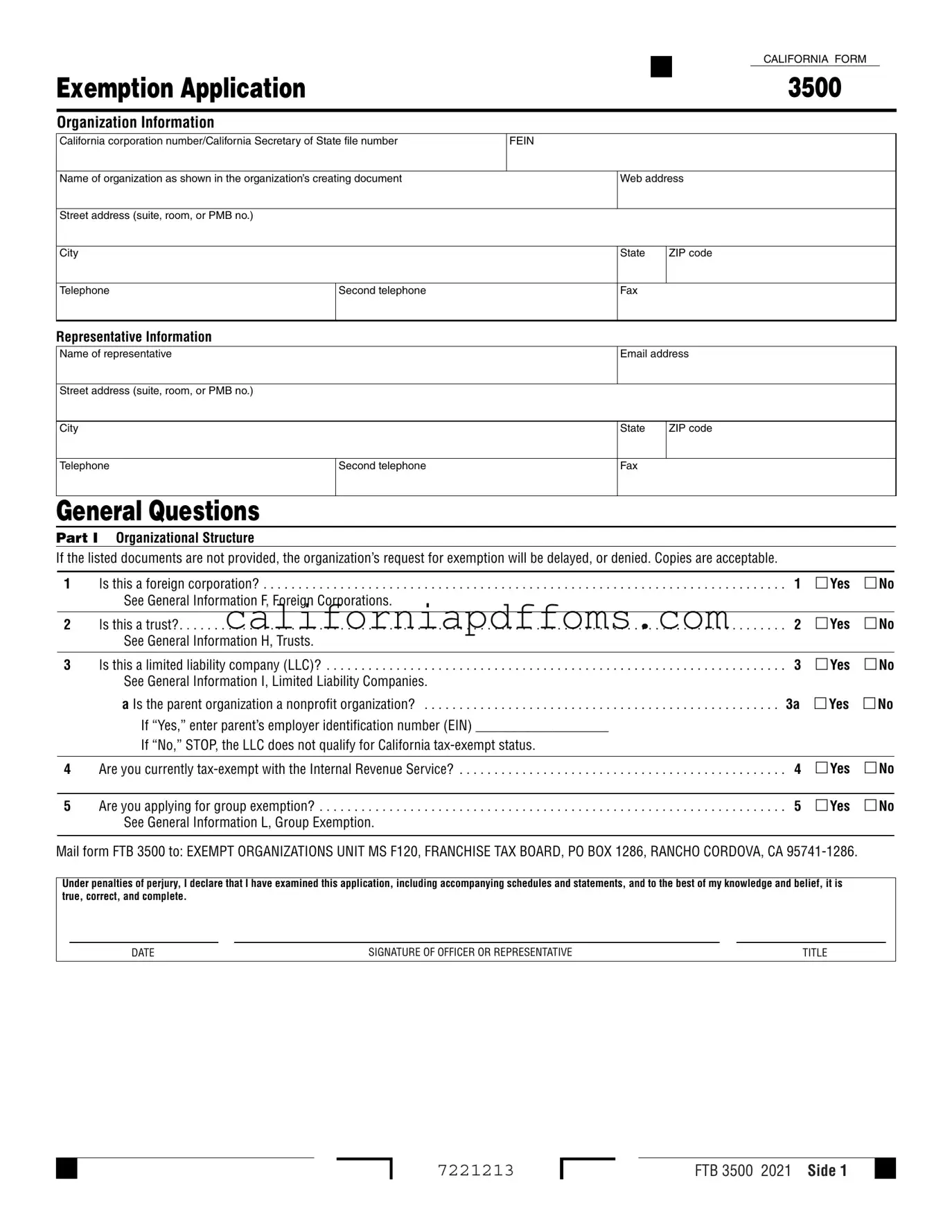

The California 3500 form is a crucial document for organizations seeking tax-exempt status in the state. This form serves as an exemption application and is essential for both new and existing organizations, including corporations, trusts, and limited liability companies. To successfully complete the form, applicants must provide detailed information about their organizational structure, including the type of entity and its federal tax-exempt status. Additionally, the form requires a narrative of activities, where organizations describe their past, present, and planned initiatives, emphasizing how these activities align with their exempt purpose. Financial data is also a significant component, as organizations must demonstrate compliance with reporting requirements and provide details about their officers, directors, and trustees. Furthermore, the form addresses fundraising activities and any potential gaming operations, ensuring that all aspects of the organization’s operations are transparent. Completing the California 3500 form accurately is vital, as any missing documentation or incorrect information can delay or even deny the exemption request. Understanding the nuances of this form is essential for organizations aiming to navigate California's tax landscape successfully.

Create Common PDFs

California Fl 145 - All parties are encouraged to seek assistance if they experience difficulty with the form.

Environmental Health Specialist - The form certifies that the applicant has completed the listed continuing education courses.