Fill in Your California 109 Template

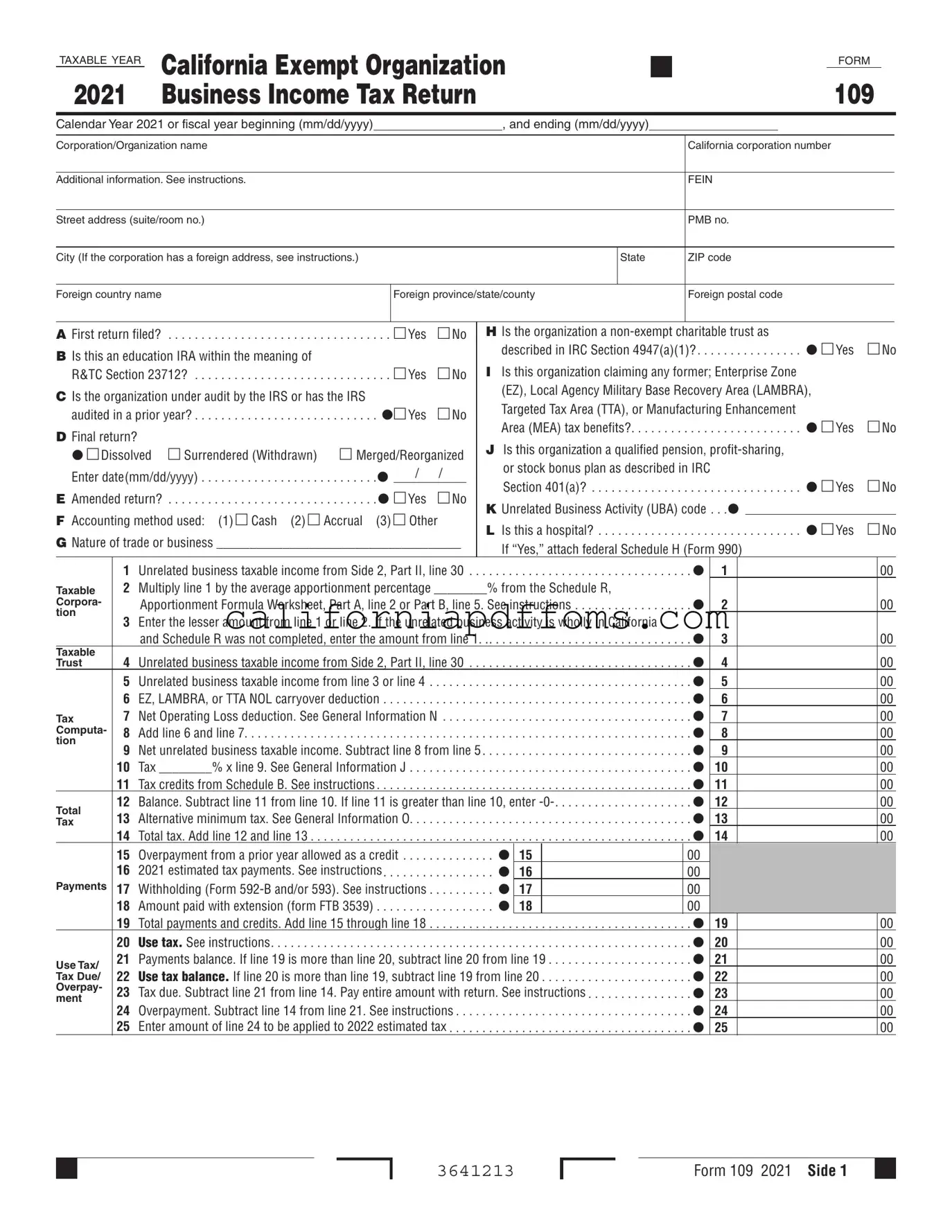

The California 109 form, officially known as the California Exempt Organization Business Income Tax Return, serves as a crucial document for organizations that are exempt from federal income tax but engage in unrelated business activities. This form is designed for the taxable year and requires detailed information about the organization, including its name, address, and federal employer identification number (FEIN). It addresses various key aspects, such as whether the organization is filing its first return, if it is under IRS audit, and whether it is claiming specific tax benefits related to Enterprise Zones or military base recovery areas. Additionally, organizations must report their unrelated business taxable income, which is calculated from multiple sources of income and deductions, including gross receipts, cost of goods sold, and various operational expenses. The form also includes sections for tax credits, net operating losses, and the calculation of total tax due or overpayment. Understanding the nuances of the California 109 form is essential for compliance and to ensure that tax obligations are met accurately and efficiently.

Create Common PDFs

Trustline Certified - The form captures the date of the application submission.

3521 - Eligible basis calculations in Part III help determine the qualified basis of a low-income building.

Notice of Appeal Form - Types of judgments that can be appealed include judgments after jury or court trials.