Fill in Your California 100X Template

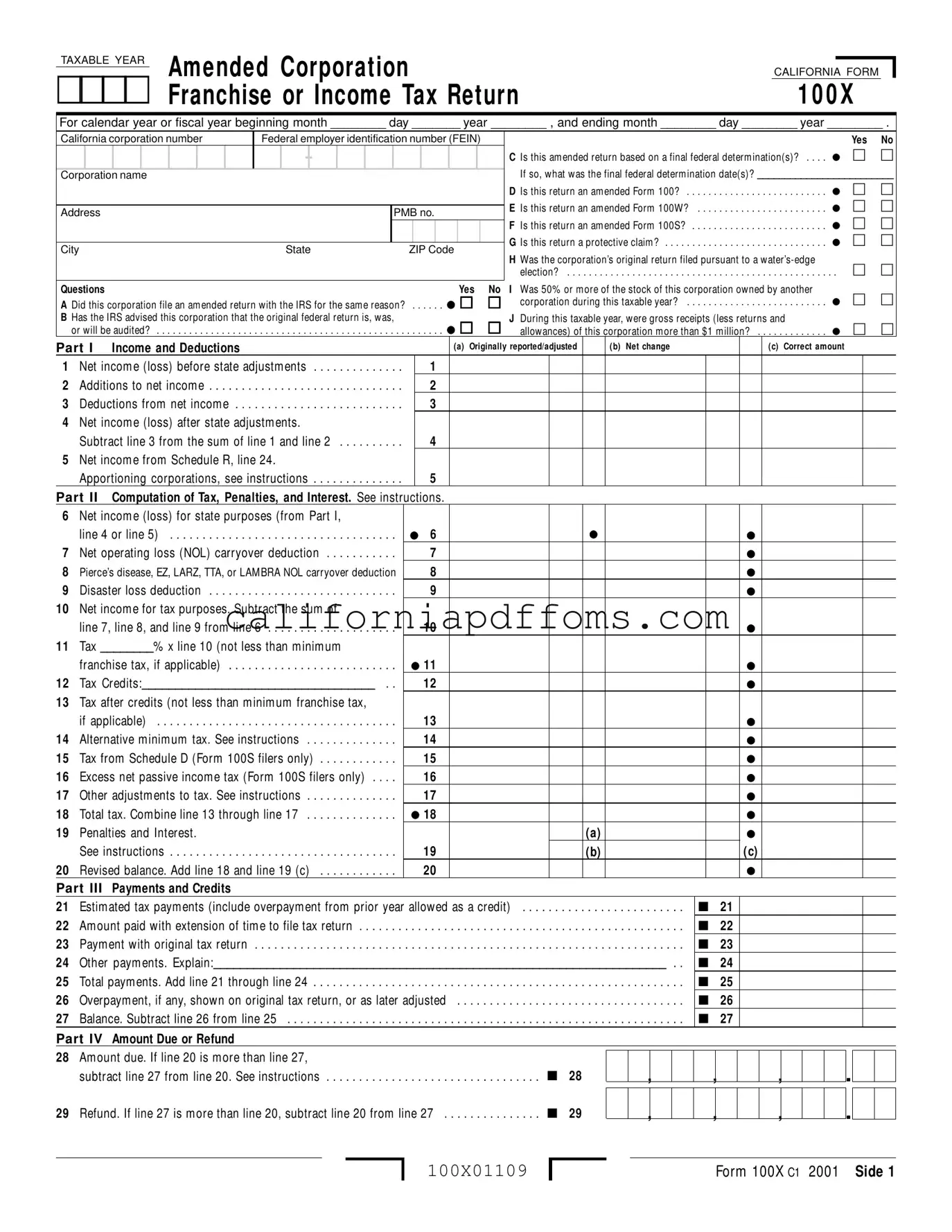

The California Form 100X serves as a crucial tool for corporations seeking to amend their previously filed franchise or income tax returns. Designed for use with Form 100, Form 100W, and Form 100S, this form allows corporations to correct errors, report changes, or claim refunds on overpaid taxes. It is essential for corporations to file this amended return after the original has been submitted, adhering to a four-year statute of limitations for refund claims. The form captures vital information such as the corporation's name, California corporation number, and federal employer identification number, along with specific questions regarding the nature of the amendments. Corporations must also detail changes in income and deductions, compute taxes owed, and address any penalties or interest that may apply. The 100X form not only facilitates adjustments to tax liabilities but also ensures compliance with state regulations following federal audits or changes. By providing a structured way to amend past returns, the Form 100X plays a significant role in maintaining accurate tax records and ensuring that corporations fulfill their tax obligations appropriately.

Create Common PDFs

Adopting a Baby Girl - The adoption questionnaire helps identify any past legal issues or concerns related to parenting.

What Happens If a Defendant Does Not Pay a Judgment California? - Legal advice is recommended for individuals unfamiliar with court processes.