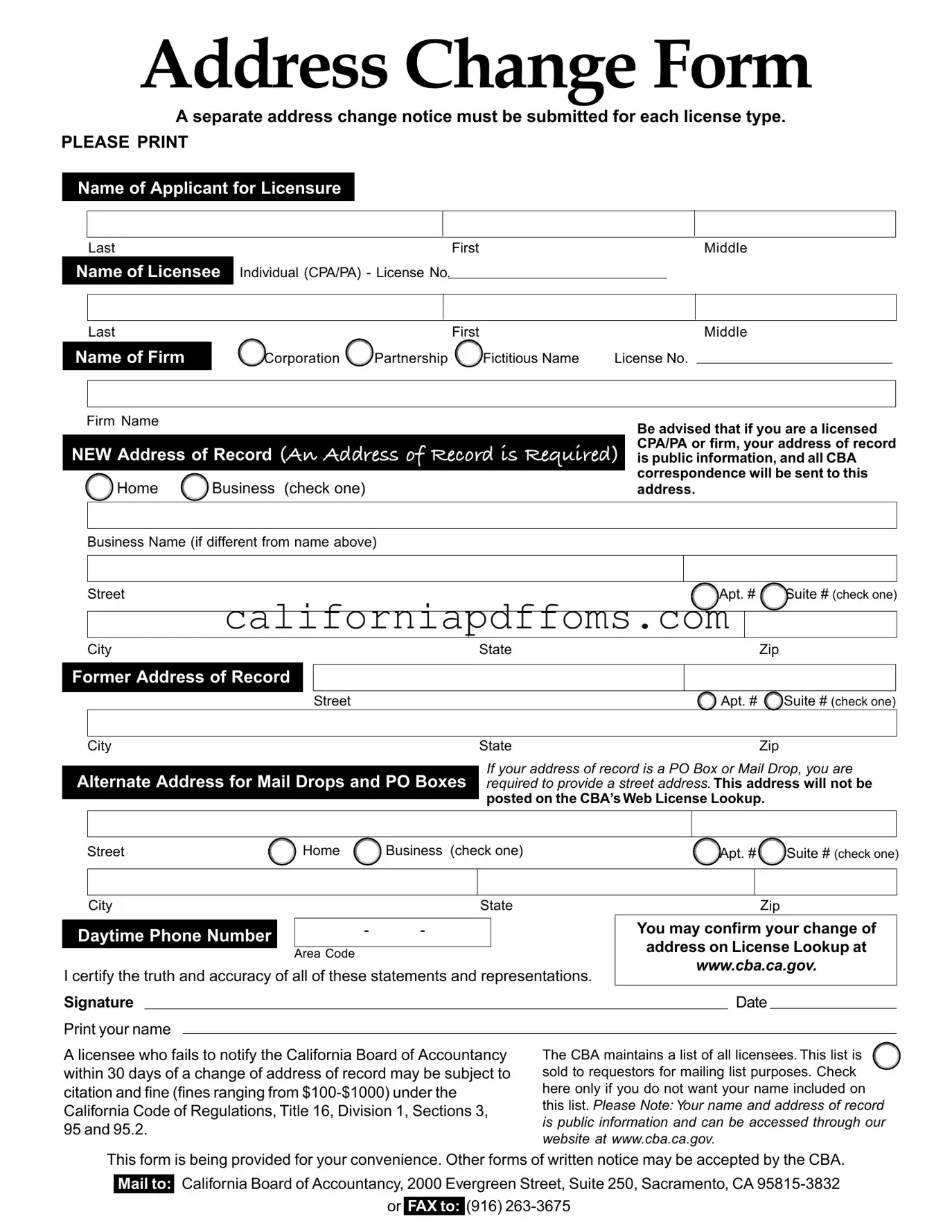

Fill in Your Address Change California Template

Changing your address in California is a crucial step for licensed professionals, particularly those in the accounting field. The Address Change California form is specifically designed to facilitate this process for Certified Public Accountants (CPAs) and Public Accountants (PAs), ensuring that all relevant parties are informed of your new location. Each license type requires a separate submission, emphasizing the importance of accuracy and attention to detail. The form requests essential information, including your name, license number, and both your former and new addresses. It is important to note that the new address of record will be public information, meaning that all correspondence from the California Board of Accountancy (CBA) will be directed to this address. If you utilize a P.O. Box or mail drop for your address of record, a street address must also be provided, although this street address will not be publicly listed. Timeliness is key; failing to notify the CBA within 30 days of an address change may result in fines ranging from $100 to $1,000. To maintain your privacy, you have the option to request that your name be excluded from the CBA's mailing list, which is sold to requestors. For your convenience, the form can be submitted via mail or fax, and the CBA offers an online License Lookup to confirm your address change.

Create Common PDFs

Ca Cosmetology License Lookup - Contact information includes a mailing address and phone number for further inquiries.

Confidential License Plate - Providing the correct telephone number aids in quick communication regarding your application.